News

finmid raises €35 million and partners with industry leaders to bring its embedded financing solutions to businesses across Europe

Summary

-

finmid empowers B2B platforms to become financial partners for customers; offering a much-needed alternative to banks for European SMBs looking for financing support

-

With just a few lines of code, finmid partners can offer their SMB customers access to finance to help them scale

-

Having tripled revenues in three months, finmid is focused on becoming the global financial infrastructure partner for B2B software platforms

finmid - the financial infrastructure innovator helping B2B platforms offer their small & medium customers access to tailored financing support – has emerged from stealth to announce it has raised €35 million in early-stage equity funding from Blossom Capital, Earlybird VC, and N26-founder Max Tayenthal. The funding comes as finmid also announces it has partnered with Wolt, a leading European tech company known for its local commerce platform.

Banking is broken – B2B software platforms are the banks of tomorrow

For hundreds of years, bank branches served as personalised outposts where local businesses could get bespoke banking solutions. In the last few decades of consolidation, banking has become distant and impersonal, leaving small & medium businesses behind. While witnessing the next economic revolution with B2B software platforms like Wolt and Safi, the banking industry has declined. finmid enables these services to act as a bank and turn on financial offerings for each of their customers, be it restaurants or retailers, bringing back the personalised touch of branches and ensuring SMBs get a tailored solution.

finmid’s vision is a future where every business has a financial partner who understands them and empowers them to grow in the way best suited to them.

“At finmid, our mission is to help every business access the capital it needs. But our approach might surprise you. How do we bring back the relationships that made banking work for so long? With just a few lines of code, finmid enables any B2B software platform to offer financing to its customers, building on existing relationships with restaurants, retailers, and traders to fuel its business growth”, says Max Schertel, Co-Founder of finmid.

Alexander Talkanitsa, Co-Founder of finmid adds: “Traditional banking will no longer be the primary source for business financing. Banks still have the largest pool of capital but struggle to deploy it efficiently. It’s time for a new way of banking. We believe B2B software platforms are the future distribution channel for financial services as they have relationships with thousands of businesses. Moreover, these platforms have access to real-time data, enabling streamlined user interactions. By leveraging the extensive reach, data insights, and relationships these platforms maintain, alongside financial capital, we're looking at a modern way of business financing.”

Leading global platforms like Wolt, Safi, and many others are partnering with finmid

Banking is one of the oldest and best business models known to man. What happens when any B2B software platform can start acting as a bank and simply turn on financial offerings for its customers? Let’s illustrate it with two examples:

Imagine your favourite local Italian restaurant: the owner, eager to upgrade the kitchen, faces the dilemma of using personal funds due to prolonged approval processes with their bank. Restaurants and cafes have long been underserved by banks and, combined with fluctuating cash flows, finances can be a tremendous source of stress.

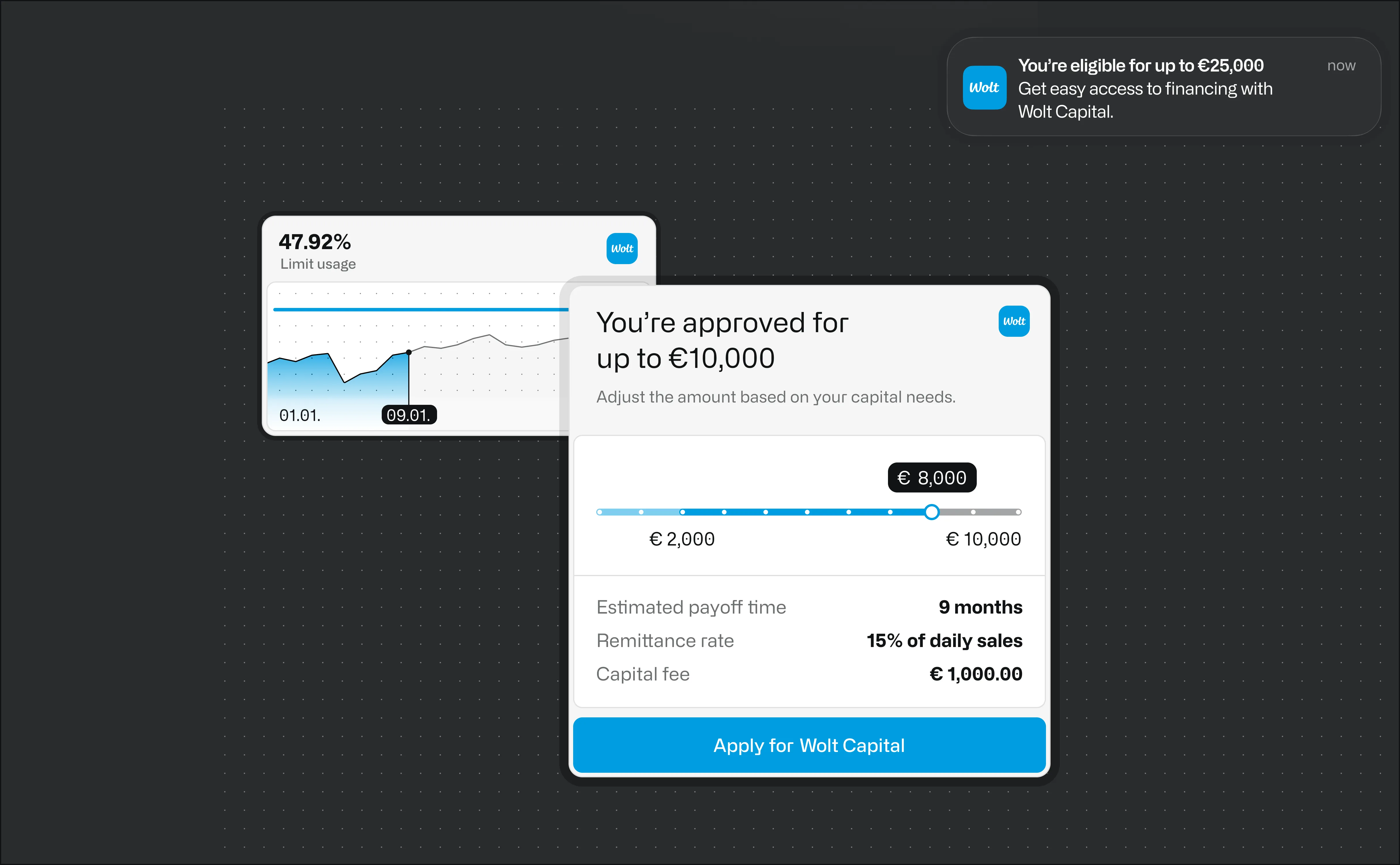

In 2023, Wolt partnered with finmid to enhance their merchant support, introducing 'Wolt Capital,' an easy cash advance feature to support their merchants.

“Overall, my experience with Wolt Capital has been very positive, and I'm thankful for the support it's provided to my business. The flexibility and the quick, efficient process make it a valuable financial tool for entrepreneurs like me”, says one of Wolt’s merchants, Nezir Giray, Owner at Five Sons Oy.

Vincent Huang, CPO at Wolt, says: “We're constantly looking for ways to support our merchant partners and help them succeed. Together with finmid, we’re able to provide easy and flexible access to additional financing - helping our partner develop their businesses, or have a safety net during tough times. The feedback we have received has been extremely encouraging, and we’re excited to see what kind of value we can create with the program moving forward.”

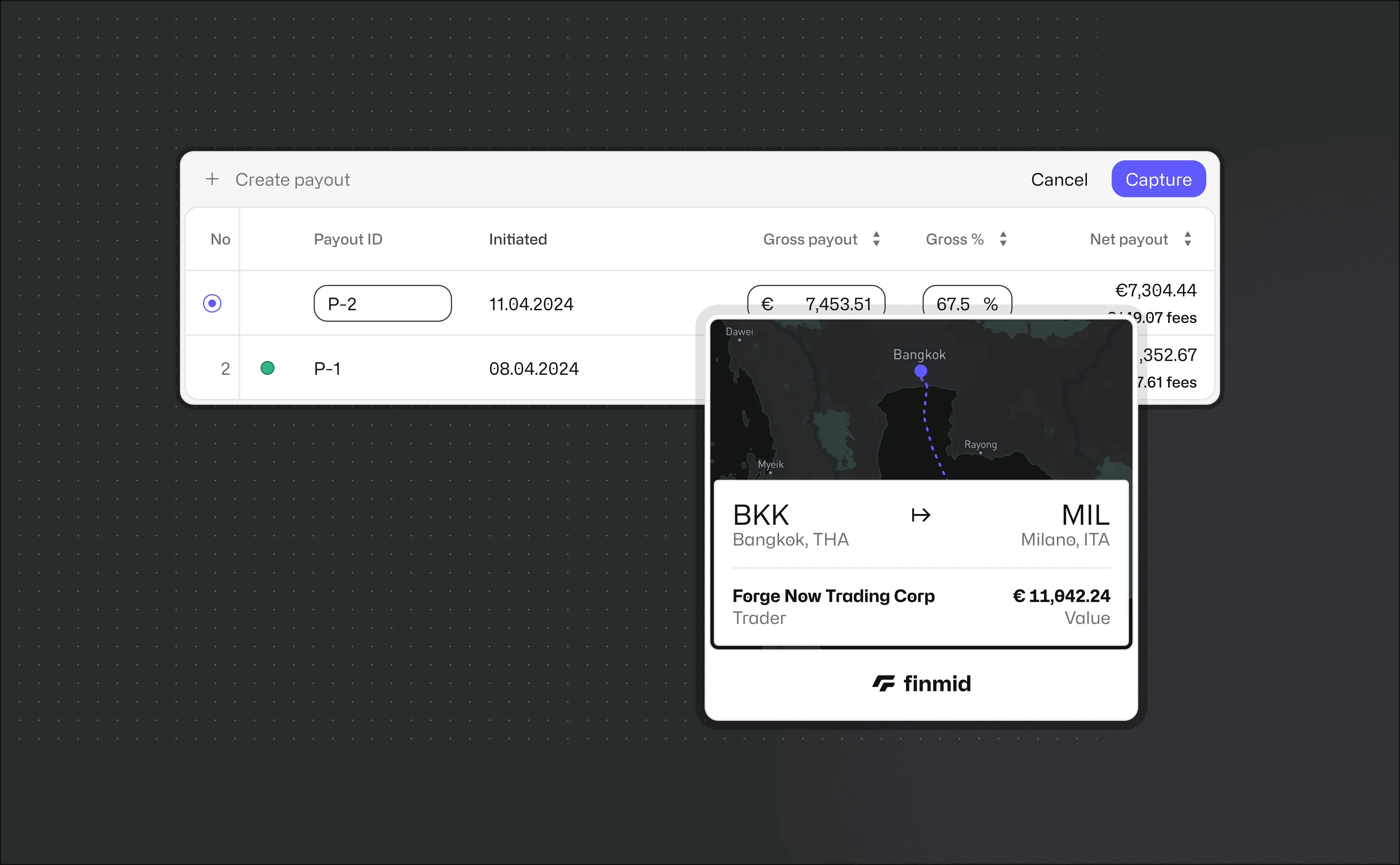

Another example is finmid’s partnership with Safi, a growing marketplace that connects recycling facilities worldwide. Now, picture a recycling facility manager finalising a deal and waiting 90 days for payments. Having just a few more outstanding payments can quickly cause cash flow issues.

finmid helps Safi by creating a bridge between global buyers and sellers through their flexible B2B Payments solution. This allows recyclable facilities to receive early payouts for initial materials, ensuring security and trust when trading globally. Buyers can also benefit from extended payment terms, helping manage their cash flow.

Rishi Stocker, CEO of Safi, says: “With finmid’s embedded B2B payments solution, we can provide financing that works seamlessly for our customers. It’s the experience we strive for on our platform.”

€35m funding to become the leading financial partner for B2B software platforms in Europe

finmid secured their latest funding round led by Blossom Capital with participation from existing investors Earlybird and N26 founder Max Tayenthal, aiming to drive sustainable growth and product innovation. The plan is to expand to core markets, localise operations, and support more financing options for easier platform integration and a smoother user experience.

Ophelia Brown, Partner at Blossom Capital, says: “You don’t need banks to offer financial services, and in many ways, they aren’t well-positioned or set up to support the next generation of small & medium businesses. Lengthy approval processes, low approval rates, and high fees are some of the challenges businesses face today in dealing with their banks. Yet, offering financial services is a highly profitable business case. We believe every B2B software platform needs to think about how to leverage financial services to serve better and retain their customers, as well as increase their margins to stay competitive in the long term. The most innovative & forward-thinking businesses in Europe are already doing so. And finmid is the best partner they can get to do it successfully.”

How finmid works

Imagine creating a financing solution for your business customers that was as easy and customisable as playing with Lego. finmid is allowing SMBs in Europe to access financing through two products:

- Capital – a solution for B2B software platforms that gives small & medium businesses immediate access to future revenues based on their sales history. This solution has been implemented with local commerce platform, Wolt, and other software providers to enable businesses in the property and hospitality sectors to get cash advances of their future earnings.

- B2B Payments – a solution that allows partners – such as Frupro, the marketplace for fruits and vegetables; recyclables marketplaces Safi, Metycle and Romco, timber marketplace VonWood, Vanilla Steel’s metal marketplace and more - to finance trading and provide essential working capital for buyers.

About finmid

finmid is the financing infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale – across industries, borders, and business models, driving revenue, improving retention, and fueling the growth of their core business. Founded in Berlin in 2021, finmid is trusted by Europe’s most ambitious platforms and backed by world-class investors. Learn more at finmid.com.

About Blossom Capital

Blossom Capital is Europe’s largest dedicated Series A fund, renowned for its high-conviction strategy and relentless belief and commitment to the region’s most visionary founders. It leverages local roots with global connections to deliver an undeniable advantage for founders across consumer internet, cybersecurity, developer tools and open source, enterprise SaaS, and marketplaces. Its investments include Checkout.com, Moonpay, Pigment, and Tines. Find out more at blossomcap.com.

About Earlybird Venture Capital

Earlybird Venture Capital focuses on European technology companies. Founded in 1997, Earlybird identifies and backs exceptional early-stage companies on a pan-European basis and supports them through their growth and development phases – providing financial resources, strategic support, plus access to an international network and capital markets. Earlybird invests out of a family of independently-managed funds. Flagship funds with early-stage focus include Digital West (Western Europe), Digital East (Emerging Europe), and Health. Newer funds Earlybird-X (pre-seed in Western Europe & university spinoffs) and Growth Opportunities (a pan-Earlybird growth fund) offer even more agility. With EUR 2 billion under management across all fund streams, 9 IPOs, and 33 trade sales, Earlybird is one of Europe’s most established and active venture capital firms. More information on earlybird.com.

You might also like

News

Announcing FruPay

Max Schertel

23.08.2023

Customer stories

How B2B marketplaces are transforming traditional industries

Jess Garnham

19.09.2023