Product

finmid unveils a range of upgrades to its B2B Payments dashboard

Unlock efficiency, drive growth, and gain deeper financial insights

Unlock efficiency, drive growth, and gain deeper financial insights

Basel Abdallah

10.09.2024

We’re excited to unveil a series of improvements to our B2B Payments product, designed to enhance operational efficiency, streamline workflows, and deliver valuable business insights to our customers. The updates are designed to support marketplaces in managing their payments and gaining a clearer understanding of their financing program. finmid’s broader mission is to empower marketplaces by providing embedded financing solutions that drive growth, unlock new revenue streams and increase loyalty by improving the overall marketplace experience.

Key updates include:

-

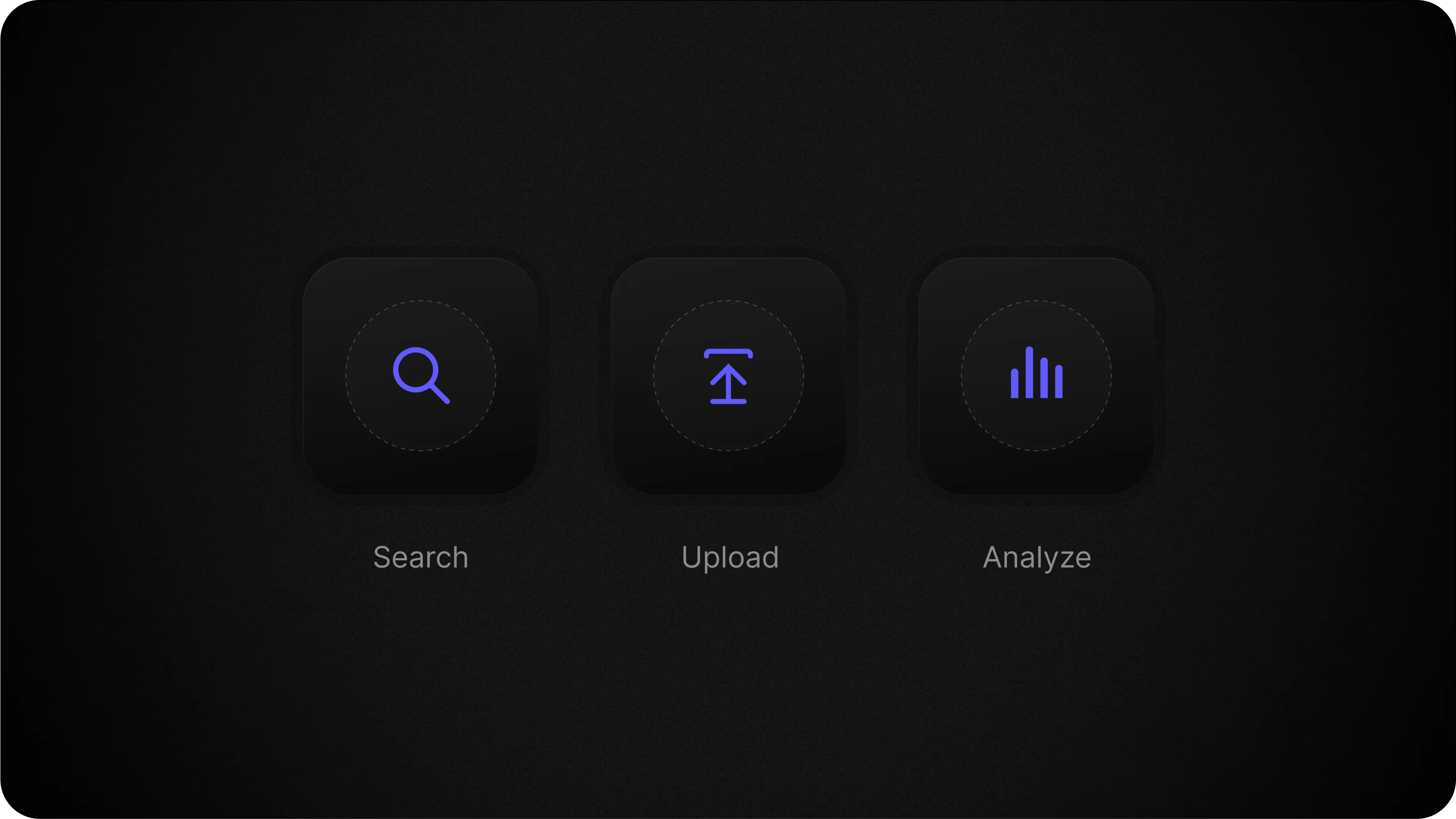

Actionable Insights: Our updated analytics page now focuses on key metrics such as Average Outstanding Volume (AOV), Gross Merchandise Volume (GMV), fee breakdowns, and buyer repayment behavior. These enhancements provide actionable insights, empowering businesses to make data-driven decisions and optimise their financial strategies.

-

Automated document upload: The new automated document upload feature simplifies and accelerates the transaction review process, reducing manual effort and minimising delays. This improvement ensures faster approvals for high-value payments and enhances operational efficiency.

-

Refined search precision: finmid’s refined search functionality delivers more accurate and relevant results, prioritising exact matches while accommodating minor typos. This update makes it easier for customers to quickly find the information they need, saving time and improving productivity.

Benefits for your business

In today's competitive landscape, marketplaces are increasingly turning to integrated financial services to differentiate themselves and add value to their offerings. Partnering with finmid means gaining access to a suite of tools designed to enhance operational efficiency and financial insight. By integrating financing solutions into your marketplace, you can offer buyers and sellers on your marketplace additional financing options, improve their cash flow, and support their growth, all while streamlining your own operations.

Oliver Morley-Fletcher, CEO & Co-Founder at FruPro, highlights: “We are thrilled with the new dashboard updates. Uploading the correct documents is now seamless. The refreshed analytics dashboard is intuitive and perfect for tracking performance. It’s clear the team listened to our needs, and these features are making a big difference."

Philipp von Lossau, CFO at Safi adds: “We have been really impressed with finmid’s commitment to continuously improve the way we work together. The improvements to their dashboards are a great example of this: they proactively asked for what would help us most, listened to our feedback and then implemented an intuitive user interface that brings relevant information to our attention.”

Why choose finmid?

At finmid, we believe that genuine innovation should simplify, not complicate. As an embedded financing partner, our focus is on keeping cash flowing on our partners’ marketplaces. Here’s what sets us apart:

-

Broad geographic coverage: Effortlessly scale with our global reach in 40 countries and five currencies.

-

Flexible credit limits: Our limits expand in sync with your growth plans and those of your partners.

-

Quick time to market: Get started within 48 hours post-contract signature, with no code required.

-

Seamless integration: Our solution integrates seamlessly with your branding to foster customer trust.

-

Instant buyer onboarding: High acceptance rates with no additional document reviews or buyer involvement.

-

Instant payments: Enjoy instant payouts of any kind, from bank transfers to direct debits.

Contact us via sales@finmid.com or learn more at finmid.com/b2b-payments.

About finmid

finmid is the financing infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale – across industries, borders, and business models, driving revenue, improving retention, and fueling the growth of their core business. Founded in Berlin in 2021, finmid is trusted by Europe’s most ambitious platforms and backed by world-class investors. Learn more at finmid.com.

You might also like

News

Announcing FruPay

Max Schertel

23.08.2023

Customer stories

Bridging the financing gap: VonWood's role in revolutionising timber trade

Max Schertel

30.05.2024