Summary

-

•

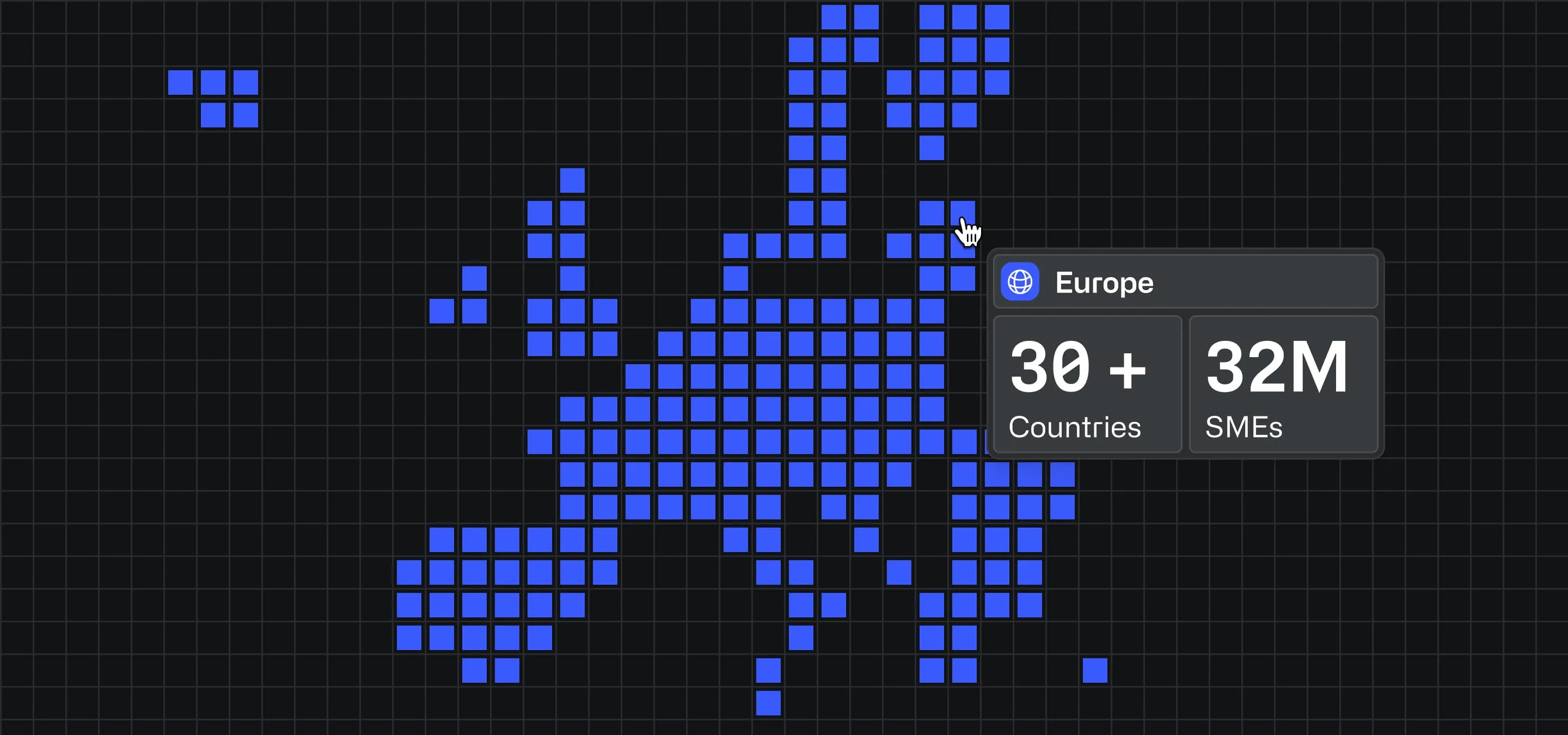

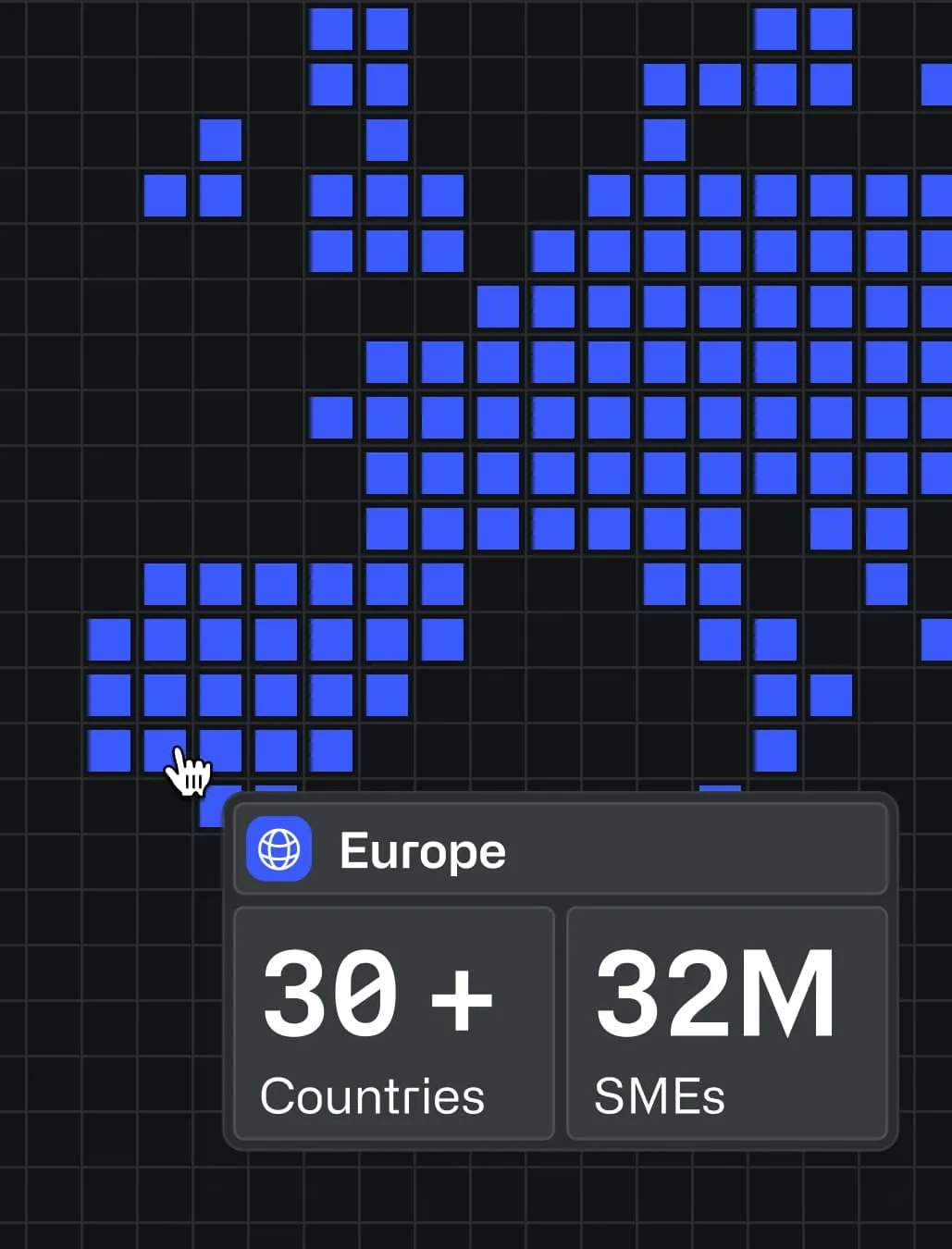

finmid’s infrastructure is now live in 30 European markets – the first time embedded finance has been available at scale across the continent via a single layer

-

•

32 million SMEs in the EU, UK, Iceland and Switzerland now have the opportunity to access capital directly through the platforms they already use

-

•

finmid has extended financing worth €4bn via partners including Wolt, Glovo (Delivery Hero) and Bolt, driving a 45% uplift in merchant revenue

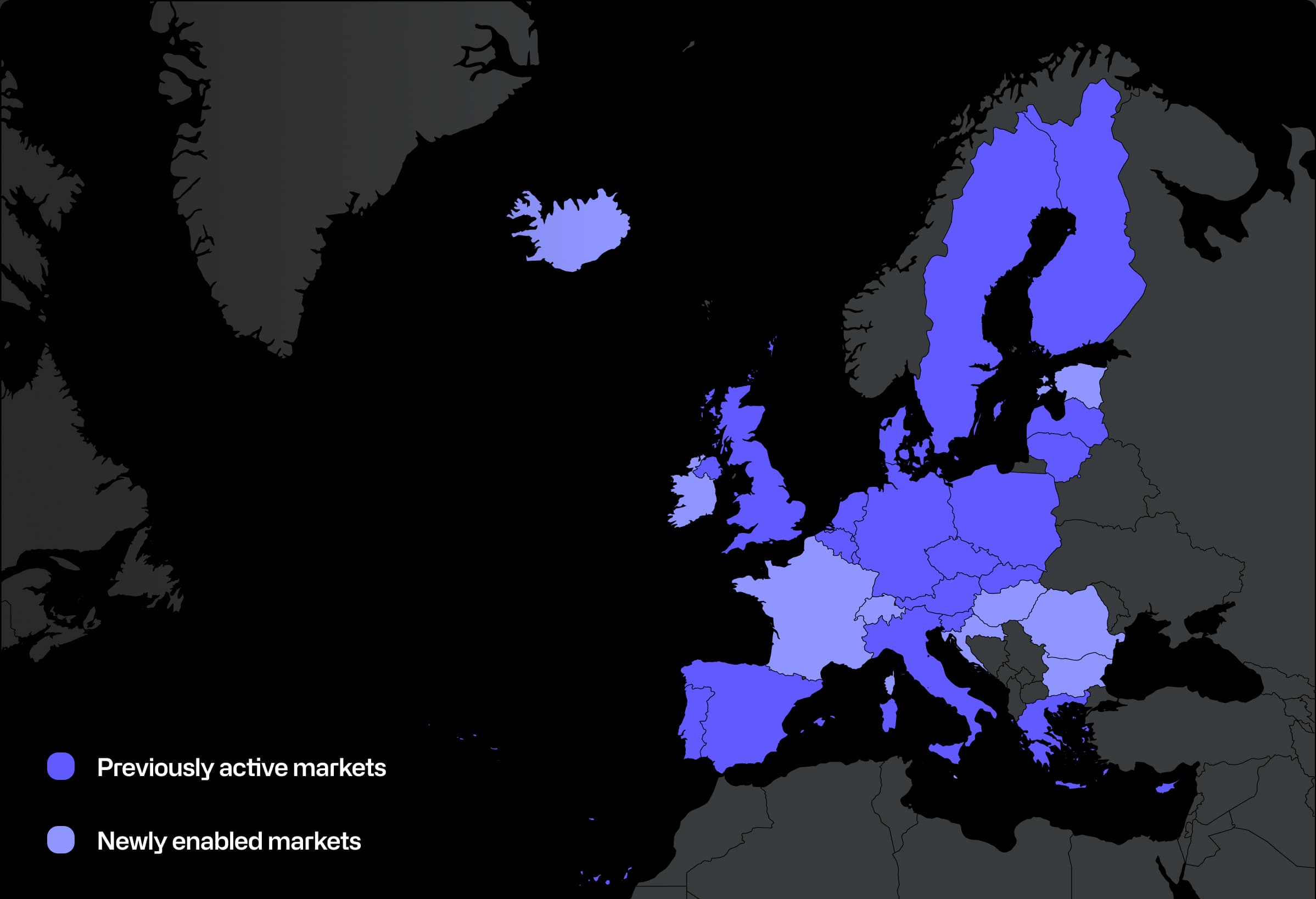

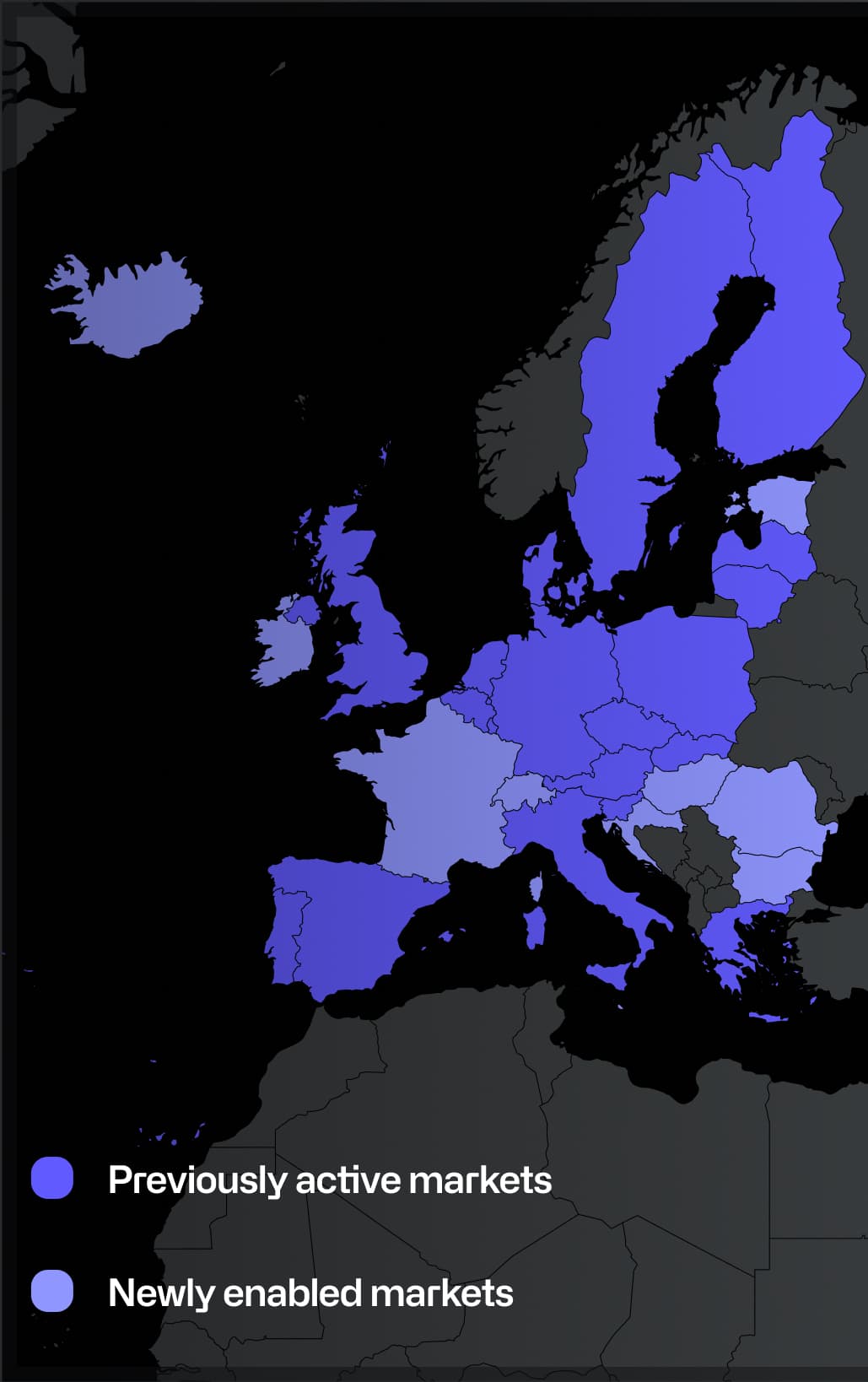

9 September, 2025:: finmid, the embedded finance provider, today announces that its embedded lending infrastructure is now available in 30 European markets, transforming growth options for over 32 million SMES across the region. finmid has added Bulgaria, Croatia, Estonia, France, Hungary, Ireland, Malta, Romania, Iceland and Switzerland to the list of countries it is serving - providing a single, easy-to-access service right across the EU and neighbouring countries.

finmid is giving platforms the same tools to offer financing in any country - giving millions more SMEs across EU member states, UK, Iceland and Switzerland faster access to capital directly from the platforms they already use. In this way finmid helps platforms and merchants to unlock new revenue streams and opportunities, giving underserved SMEs the opportunity to fulfil their potential.

Historically, platforms struggled to offer financing across Europe due to a complex patchwork of local regulations and infrastructure. This created an uneven playing field, where a company’s access to capital was determined by its location, not its growth potential. But finmid’s single financial layer for the single market achieves a goal that EU regulators and policymakers have struggled with for decades.

“Europe’s dream of a single market has been held back by a financial system that stops at borders,” said Alexander Talkanitsa, Co-founder of finmid. “Embedded lending has always had the potential to change that, but the reality was fragmented and slow. With this rollout, any platform can, for the first time, offer capital to its customers everywhere in Europe. This changes the game. With this barrier removed, the next decade of growth for European SMEs is made possible on a region-wide scale.”

Closing Europe's €400bn financing gap

Embedded lending has become a lifeline for small businesses in recent years, with the decline of local banking networks and traditional lenders still relying on outdated credit scoring. Difficulties in securing finance have created a €400bn financing gap for Europe’s SMEs. finmid’s integration gives platforms the ability to extend capital to new markets on equal terms, no matter where businesses are based, at the touch of a button.

“At finmid we’re solving the problems that hold back SME businesses, often small family-run companies, from growing, even when demand for their product is there. I’ve never been prouder than seeing the companies we support able to open new premises or buy essential equipment. finmid’s embedded finance is not only achieving the key European ambition of a borderless, single financial layer for the single market but delivering for those businesses that create jobs and deliver prosperity.”

said Max Schertel, Co-founder of finmid.

Since launch, finmid has rapidly become the backbone of European businesses, having extended more than €4bn in capital offers to European SMEs via partners including Wolt, Glovo (Delivery Hero), Bolt, and more. Data from its network has shown that platforms offering finmid’s embedded finance can increase Gross Merchandise Value (GMV) by up to 45% and reduce churn by 70%. However fewer than one in ten SMEs benefit from embedded lending but finmid’s technology will make it easier for many more underserved small businesses to increase revenues by giving them access to capital on terms that suit their cashflow.

Existing partners Wolt and Glovo are already planning to extend their financing solutions in the newly enabled markets, using finmid’s speed and ease-of-use to open new countries quickly and without friction.

“For us at Wolt, the success of our merchants is at the heart of what we do,” says Anniina Heinonen, Managing Director, Payments at Wolt. “We’re always looking for new ways to empower them, and access to additional financing has been a clear need across many of our markets. By working with finmid, we can now meet that need and help local businesses across Europe grow without delays.”

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.