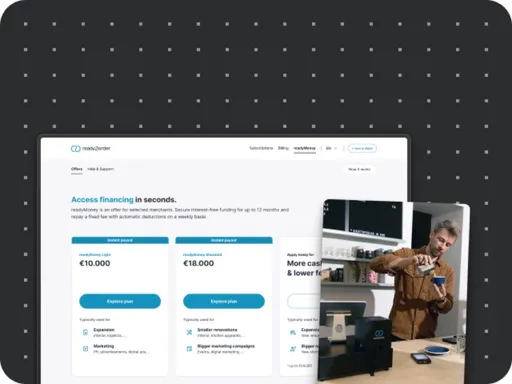

Today, we are announcing the roll-out of two new products – Term Loans and Business Loans – to complement our existing Cash Advance product and complete the finmid Capital product line. With these additions, platforms can now offer every merchant, from micro business to established enterprise, funding in 30 European markets through a single integration. Paired with pre-approved offers, instant payouts, flexible repayments, transparent terms and no collateral requirements, platforms can deliver best-in-class UX for every merchant and use case.

Bridging the growth gap beyond cash advances

Many platforms already embed lending products to improve margins, retention, and differentiate from competition. While cash advances, the most common embedded lending product today, are best suited for short-term, revenue-based financing needs, they do not capture the broader spectrum of business funding needs.

A significant merchant segment remains underserved by cash advances: more mature and established merchants with the need for predictable or long-term, large scale funding. On many platforms, a relatively small cohort of midsize and large businesses accounts for more than 50% of revenue. These businesses typically require ticket sizes above €1 million and often payment terms longer than 12 months. Without serving these business segments, platforms:

-

•

Miss out on scaling embedded lending as they cannot provide offerings across all customer segments

-

•

Miss out on deepening customer relationships since businesses "outgrow" cash advances

-

•

Add complexity by working with multiple lending partners to serve the full lifecycle of business funding needs

Term Loans and Business Loans for predictable, large scale funding

Term Loans and Business Loans address precisely this gap, enabling platforms to support merchants across all size and growth phases, completing full-lifecycle embedded lending. With the introduction of these products, finmid Capital consists of three products:

-

•

Cash Advance: fast, easy, flexible funding option, ideal for micro-businesses who want to synchronise their payments with revenue.

-

•

Term Loan: fast funding option for more mature businesses who want to sustain or grow, with fixed, predictable repayments.

-

•

Business Loan: built for scale, this product is best suited for established businesses in need for structured growth financing with large capital needs and multi-year repayment schedules.

Overview: finmid Capital products

| Product | Cash Advance | Term Loan | Business Loan |

|---|---|---|---|

| Max funding amount | €1M | €5M | €5M |

| Max term | 12 months | 12 months | 5 years |

| Repayment structure | Flexible, based on revenue | Fixed, based on a predictable schedule | Flexible or fixed |

| Typical use case | A restaurant needs to purchase inventory or renovate its terrace before the busy season, repaying flexibly from daily sales | An e-commerce merchant finances a bulk inventory order or marketing campaign, choosing predictable monthly repayments to better plan margins and cash flow | A vacation rental operator invests in acquiring additional properties to expand their portfolio ahead of the high season, requiring long-term funding with higher limits and multi-year repayment terms |

Cash Advance

Term Loan

Business Loan

All of the Capital products are available in EU27, UK, Switzerland, and Iceland have transparent terms with a fixed fee, 24h payouts, and no collateral requirements.

More revenue and loyalty for platforms across all business lifecycles

With this new offering, platforms who work with finmid can unlock multiple benefits:

-

•

Serve merchants of all business sizes: No more lending product rollout for a limited customer base. Platforms can offer merchant-tailored financing for all business sizes.

-

•

Boost retention and lifetime value: Platforms can offer lending products that scale with their merchants' businesses, fostering loyalty at every stage of growth.

-

•

New revenue opportunities: Platforms can capture more revenue by offering various financing solutions to a larger customer base.

-

•

One partner, less friction: finmid Capital operates through the one provider and API. Platforms do not need to assemble with multiple vendors or integrations, reducing operational friction and creating a transparent experience across all financing journeys.

Curious to see how embedded lending could work for your platform? Book a demo.

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.