Turning payments into growth: embedded lending for PSPs

PSPs are scaling up, and so are expectations

The PSP space is currently in a strong growth phase, as an increasing number of businesses are relying on them to power checkout, payouts, and all other things regarding payments.

The statistics speak for themselves: the global PSP market is set to grow at about 11% annually over the coming decade. Source: Reports and Insights

With that comes a challenge: as new technology and new players are constantly improving the payment experience, PSPs are forced to evolve quickly and keep widening their offering to merchants, well beyond processing transactions.

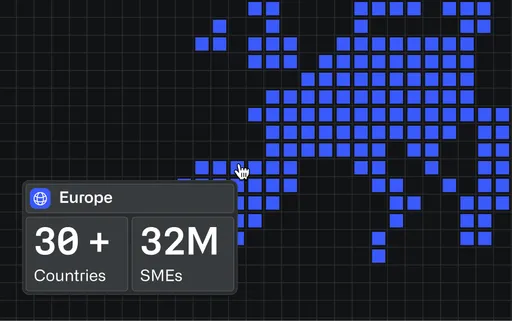

One continent, very different realities

Across Europe, PSPs face very different realities depending on region. In Northern and Central Europe, payments are highly developed and innovation is at an all-time high. New POS and PSP players keep entering, and core features get copied fast. While that is great for merchants, it also means differentiation through payments alone is getting harder.

PSPs here are increasingly pushed to look beyond the checkout experience and expand their value in ways that are harder to replicate.

In Southern and Eastern Europe, businesses are digitizing rapidly, yet access to growth capital has not caught up. Many merchants still face slower, more limited funding options than in other regions.

Because PSPs are already embedded in daily transactions and payouts, they are often the most natural and trusted point for merchants to turn to when funding is needed.

The combination of proximity to business and real-time data puts PSPs in a uniquely strong position to widen their offering, and step into the gap with embedded lending: a natural extension of the role they already play.

A shared opportunity across Europe

Across all of Europe, one thing holds true: embedded lending is one of the most powerful ways for PSPs to expand their role from payments partner to growth partner.

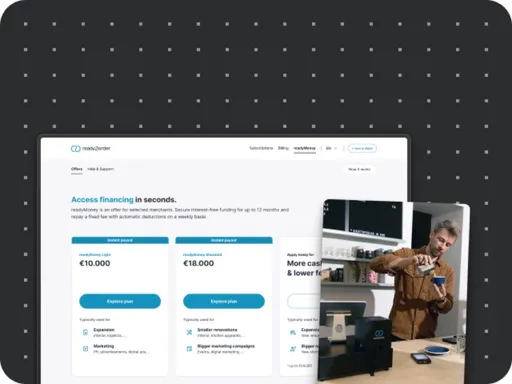

Because PSPs already sit on real-time transaction data and merchant workflows, they can offer both fixed and revenue based financing at exactly the right moment, inside the tools merchants use every day. That makes lending feel less like a separate product and more like a natural part of running the business.

In practice, the upside is clear:

-

•

Direct boost to merchant growth:

Direct boost to merchant growth: Embedded lending has a measurable effect on performance. On average, every €1 of funding generates around €0.5 in additional GMV, as merchants invest in new locations, operational upgrades, or inventory.

-

•

Stronger loyalty over time:

When funding lives inside the PSP experience, merchants do not just use it once. Around four in five come back for repeat financing, and they are roughly three times more likely to stay with their PSP over the long term.

-

•

A complete financial offering:

Embedded lending lets PSPs round out their fintech portfolio and become a one-stop partner for merchants' financial needs. It adds a growth product on top of payments, deepening platform value while opening a new, scalable revenue line.

Embedded lending gives PSPs a rare chance to create value that does not disappear the moment a competitor ships a similar feature.

Merchants get timely capital that matches how they earn, and PSPs become more than a payment rail: they become a platform that actively supports growth. In a market moving this quickly, that shift from "processing" to "enabling" is what turns a PSP into a long-term partner.

Curious to see how embedded lending could work for your platform? Book a demo.

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.