When crisis struck: How Wolt Capital, powered by finmid, helped Mia Glikia Istoria keep its doors open

Meet Nikos Dedes, founder of Mia Glikia Istoria

Growing up in Athens, Nikos always dreamed of creating his own business centered on ice cream and sweets. After years of working in restaurants, he finally opened his own shop in 2012 – right in the middle of Greece's financial crisis.

The timing was far from ideal. From economic downturns, to capital controls in 2015, to the COVID-19 pandemic, Nikos and his team had to navigate one challenge after another. But their commitment and dedication carried him forward.

“Every two or three years, a new crisis came. It was very difficult, but it made us stronger and more resilient,”

says Nikos.

Challenge: When the most essential piece of equipment fails

Last year, another disaster struck: Nikos' gelato case – one of the most essential (and expensive) pieces of equipment in his shop – suddenly failed.

Without it, he could not serve his signature product and risked losing customers. What had taken years to build was suddenly in jeopardy, and finding a quick solution became critical.

Solution: Wolt Capital – the right financing at the right time

This is when Wolt Capital, powered by finmid, stepped in and provided a merchant cash advance that unlocked access to the necessary funds.

The process was fast and straightforward. Within 6 hours, Nikos had the capital needed to purchase a new gelato case. A few days later, his new gelato case was installed and his shop was running again.

“Everything was very easy and very quick. At that moment, Wolt Capital was exactly what I needed,”

says Nikos.

Results: New equipment within days, not weeks

Instead of waiting weeks for funding and risking a shutdown, Nikos received the capital within hours and had his new gelato case up and running just a few days later. Furthermore, the financing did not just solve an urgent problem – it also gave Nikos the confidence to plan for the future.

Today, Mia Glikia Istoria is expanding and considering another merchant cash advance, with plans for a new menu, kitchen upgrades, and even a second location in Athens.

As Mia Glikia Istoria celebrates 13 years in business, Nikos continues to focus on what matters most: quality, innovation, and community. From introducing new menu items to dreaming of expansion, he is determined to keep growing while staying true to the heart of his business.

“Every positive review, every customer who appreciates our work – that gives me the strength to continue.”

About Wolt Capital, powered by finmid

Mia Glikia Istoria is one of many businesses that Wolt Capital has helped not just to survive, but also thrive. So far, tens of thousands of merchants across 18 countries have received a cash advance, with over 84% renewing: a clear sign of trust and demand.

Why do merchants choose Wolt Capital? With eligibility based on Wolt sales history, funds often arrive in hours, and payments adjust automatically based on sales per-formance. Pricing is simple and transparent, with a clear, upfront fee, no hidden costs.

Curious to see how this could work on your platform and enjoy similar benefits as Wolt? Book a demo.

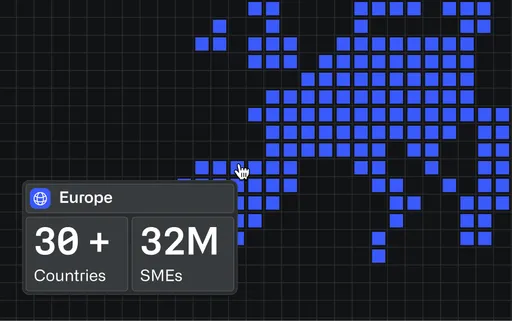

finmid is the embedded lending infrastructure powering platform growth. With its API, finmid enables platforms to launch tailored financing products for their business customers at scale. Across industries, borders, and business models, finmid drives revenue, improves retention, and fuels core business growth. finmid is trusted by Europe’s most ambitious platforms, including Wolt, Delivery Hero, Just Eat Takeaway, Glovo, and FREENOW. Learn more at finmid.com.